bangladesh bank loan classification auto brickfield

Bangladesh: Financial System Stability Assessment

Bangladesh: Financial System Stability Assessment . This Financial System Stability Assessment on Bangladesh was prepared by a staff team of the International Monetary Fund and the World Bank as background documentation for the periodic consultation with the member country. It is based on the information available at the time it was

Determinants of Customer Satisfaction of Banking Industry ...

Bangladesh is Bangladesh Bank. The financial system as well as financial sector of ... service, and loan and advances (term loan, car loan, education loan, housing loan, micro group credit, micro credit enterprise, etc.). They also offer corporate banking, loan ... classification given by Schmenner (1986) is important. Schmenner divided ...

Five rights of loan defaulters The Economic Times

Apr 11, 2016· Five rights of loan defaulters If you have defaulted on a loan, the rules don't give lenders a complete walkover. Here's what to bear in mind if you find yourself in such a situation.

Loan Disbursement and Recovery System of Ific Bank Limited

"Loan Disbursement and Recovery System of International Finance Investment and Commerce Bank Limited" ... Credit Risk Management of National Bank Limited, Bangladesh 8717 Words | 35 Pages ... LOAN CLASSIFICATION, PROVISIONING AND DEBT DEFAULT TREND IN MERCANTILE BANK LIMITED SECTION – 1 INTRODUCTORY PART Preface Now a day present ...

Understanding the 4 Types of Notes Payable To Banks

The amount of paperwork associated with borrowing money from a bank can be truly daunting. Whether you are taking out a loan to get money to buy a car or borrowing to purchase a new home, one of the most important documents the lender will ask you to sign is a promissory note.

Factors Affecting Access to Finance of Small and Medium ...

The latest data, according to Bangladesh Bank (BB), reveals the following information (see table 2) in regard to the number and classification of banks and the target of loan disbursement by banks and nonbank institutions. Table 2: Loan disbursement by banks and nonbank institutions in Bangladesh in crore ( billion) taka.

New BB rules feared to raise loan defaulters | Bangladesh ...

Aug 01, 2012· News and development of economy of Bangladesh. The financial Express, 1 August 2012. Textile millers have urged the central bank not to implement new loan classification, provisioning and rescheduling rules, fearing it would increase the number of loan defaulters.

BB gives banks big breaks over defaulted loans

Bangladesh Bank has relaxed rules regarding defaulted loan classification by extending the time for treating overdue loans as doubtful and bad, giving further breaks to banks in this connection. To this end, the central bank on Sunday issued a circular amending its earlier rules issued in 2012.

Loans and Advance | Banking Guide for Bankers

Now the question may gradually arise how the bank will provide interest to the clients and the simple answer is – Loans Advance. Credit is continuous process. Recovery of one credit gives rise to another credit. In this process of revolving of funds, bank earns income in the form of interest. A bank can invest its fund in many ways.

Types of Collateral for Different Loans

Types of Collateral for Different Loans. ... This is important if there is a substantial difference between the bank's appraisal and what the asset is worth in the view of the company's management. ... Auto loans are used by individual borrowers and businesses to purchase a used or new vehicle. The main types are unsecured and secured ...

A Comparative Study of Prudential Regulation on Loan ...

Loan is the prime asset of a bank. So it is essential to know the asset quality of a bank and regulation helps to determine the financial health and efficiency of the banking sector. Besides, a proper loan classification and provisioning system ensures credibility of the financial system that in turn restores trust and confidence in the mind of ...

Lending Industry Analysis Research – DB Hoovers

Industry Overview. See Companies in the Lending Industry. ... In the United States the SIC code is being supplanted by the sixdigit North American industry Classification System (NAICS code). 5932, 6082, 6111. ... Major products and services include charge and credit cards, mortgages, auto loans, payday loans, student loans, and business loans.

circularlist Microcredit Regulatory Authority

Microcredit Regulatory Authority (MRA) is the central body to monitor and supervise microfinance operation of Nongovernment organizations of Bangladesh circularlist Microcredit Regulatory Authority

Market Disclosures for December 2013 Janata Bank Limited

as per Bangladesh Bank's instruction that defines the risk profile of borrower's to ensure that account management, structure and pricing are commensurate with the risk involved. JBL is very much concern in managing nonperforming loan. JBL follows Bangladesh Bank's BRPD Circular for classification of loans advances provisioning.

Government Rules and Regulations Roads Highways

A person should be a Bangladeshi national and a permanent resident in Bangladesh to be appointed to the Cadre Service. Any national married or promised to be married to a foreign national will not be eligible for such an appointment. There are presently twenty nine Cadre Services and the Bangladesh Civil Service (Roads Highways) is one of them.

Mustknow: The 8 types of bank risks Market Realist

Any bank has to take on risk to make money. ... or loans, liabilities, or deposits, and other exposures. The department also communicates the bank's risk profile to other bank functions and takes steps, either directly or in collaboration with other bank functions, to reduce the possibility of loss or to mitigate the size of the potential ...

Finance Division, Ministry of FinanceGovernment of the ...

পদ সৃজন, বিলুপ্তিকরণ এবং সাংগঠনিক কাঠামো অনুমোদন সংক্রান্ত ...

Banking Office Hours

We have extended our branch operation hours with effect from 26th September 2016 to facilitate the replacement of your Debit Card to the PINenabled MyDebit Card.

Khan Muhammad khan Senior Officer (SME Financing ...

• Sending and complying with Bangladesh bank regarding reports. Preparing quarterly reports like Capital Adequacy Market Discipline(CAMD), Stress Testing, Statement of Loan/Lease Classification Provisioning (FICL). • Consolidating reports from branches. • Cross checking with accounts department.

How to Fill Out a Loan Application |

When it's time to ask for a loan to kick your idea into existence, the loan application usually a standard form from your lender is something you simply do not want to botch.

Dhaka Bank Limited | Excellence in Banking

Dhaka Bank has truly cherished and brought into focus the heritage and history of Dhaka and Bangladesh from Mughal outpost to modern metropolis. Most of its presentation, publications, brand initiatives, delivery channels, calendars and financial manifestations bear Bank.

Appeasing the bank loan defaulters

In a circular issued on Sunday, Bangladesh Bank brought about changes to the loan classification policy which facilitates loan defaulters. This new regulation will come into effect in June this year. Under the new provision, businesspersons can be free of default even if their loans .

Regulatory authorities and supervisory agencies

About BIS The BIS's mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks.

Latest Posts

- طحن أم لأحجام الشاشة

- شرح الطاحن الكرة مطحنة

- مصنعي لفة مطحنة في المملكة العربية السعودية

- كسارة فكية مستعملة للبيع في المكسيك الجديدة

- حجر الجرانيت سحق مصنعي الآلات

- تكلفة مصنع فاصل خام النحاس عمان

- بيع مطحنة الكرة تصدير الولايات المتحدة الأمريكية

- آلة بيليه الأعلاف الحيوانية للاستخدام المنزلي

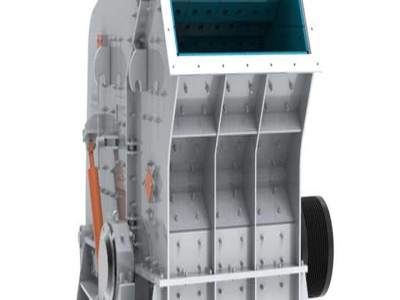

- تكلفة آلة الكسارة RCC

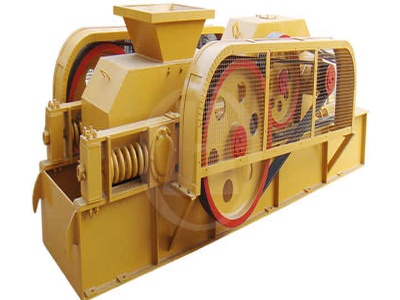

- 2 كسارات الحجر جنبا إلى السودان

- الرصاص والزنك مسحوق مطحنة المورد

- مصنع ماكينات الرمال الصناعية

- معدات التكسير الأولية للنحاس كيف التكلفة

- الصالةل سعر كسارة 25ton القدرات

- آلة نقل الرمل في كويمباتور

- is ball mill confined

- grinding basalt set

- what is the percentage of iron in pyrite hematite siderite

- what size duetz engine does a extec jaw crusher have

- properties of sand grinding

- proposal for cold stone creamery

- how to make a gold crusher html

- machine for crushing stones for sale in south africa

- pe 150 250 jaw crusher manufacturer

- medium scale mining in nigeria

- brand name stone crusher

- artificial sand equipment subsidy andhra government

- business plan for small gold mining company

- what is the parts on ball mill

- mining tools china