capital gains tax in australia wikipedia the free

Capital Gains Tax New Zealand: What You Should Know ...

Bookabach and Airbnb. Not capital gains tax, but home owners who rent a room or their bach to holiday makers often have the misconception that it's tax free. It's true that you don't pay tax on income from a limited number of "boarders" in your house. But if you rent a room in your home or your entire bach to holidaymakers, expect to pay tax.

Capital gains tax synonyms, capital gains tax antonyms ...

Because a capital gains tax rate reduction increases individual investors' preference for longterm capital gains, these investors bid up the prices of nondividendpaying stocks that are expected to generate gains through appreciation in value relative to stocks that .

How To Reduce Tax In Australia | Smart Family Budget

Sep 21, 2017· One thing to be very careful of if you decide to claim any part of the interest on your mortgage is that it may affect your ability to sell your home tax free. You see, currently in Australia, your principal place of residence can be sold and any capital gain resulting from the sale is exempt for capital gains tax (CGT) purposes.

Calculating Capital Gains Tax (CGT) On Shares

Aug 03, 2018· The most common tax implication when investing in shares is calculating the capital gains tax you must pay when you sell shares that have made you money (a profit). Any investment that generates positive returns, aka makes you money, is subject to capital gains tax.

LongTerm Capital Gains Tax Rates in 2018 Yahoo Finance

Dec 11, 2017· A 0% longterm capital gains tax rate applies to individuals in the two lowest (10% and 15%) marginal tax brackets. A 15% longterm capital gains tax rate applies to the next four brackets 25%, 28%, 33%, and 35%. Finally, a 20% longterm capital gains tax rate applies to taxpayers in the highest (%) tax bracket.

Understanding LongTerm vs. ShortTerm Capital Gains Tax Rates

Apr 20, 2019· LongTerm Capital Gains Tax Rates. In 2017, the capital gains rate for those in the 10% and 15% income tax brackets is 0%, meaning those who earn the least are not required to pay any income tax on profits from investments held longer than one year. For those in the 25% to 35% tax brackets, the capital gains tax is 15%.

Capital Gains Tax Australia Free downloads and reviews ...

capital gains tax australia free download iScheduleD Capital Gains Manager, Australia Tax Return, Bajaj Capital Tax Planning Guide, and many more programs

Avoiding Capital Gains Tax When Selling Your Home: Read ...

If you sell your home, you may exclude up to 250,000 of your capital gain from tax or up to 500,000 for married couples. You probably know that, if you sell your home, you may exclude up to 250,000 of your capital gain from tax. For married couples filing jointly, the exclusion is 500,000.

Taxation in Sweden Wikipedia

Income taxEdit. For an average salary, on an additional pay of 100 kronor, the employee first pays 32 kronor in income tax (direct, 32%); on top of that, the employer pays an additional kronor in employer's social fees (indirect, %) as a fee for the employee's adherence to the Swedish social security scheme.

Capital gain tax The Free Dictionary

Capital gain tax synonyms, Capital gain tax pronunciation, Capital gain tax translation, English dictionary definition of Capital gain tax. n a tax on the profit made from the sale of an asset. Abbreviation: CGT Noun 1. capital gains tax a tax on capital gains; "he avoided the capital gains...

Does a beneficiary pay capital gains tax in land recently ...

Apr 18, 2006· In Australia is inherited farm land subject to capital gains tax. The land was in a holding comapny of which there were 3 major share holders and somehow it is all going to pass to me in exchange for . read more

Capital Gains Tax Calculator Good Calculators

Capital Gains Tax is the tax taken from the profit you have gained when you sell or dispose of an asset which has increased in value A collection of really good online calculators for use in every day domestic and commercial use!

Capital Gains Tax Laws in North Carolina | Pocketsense

North Carolina Individual Income Tax 2017. The capital gains tax rate is 15 percent for taxpayers in the 25, 28, 33 and 35 percent tax brackets, climbing to 20 percent for those in the percent bracket. That top bracket starts at 418,400 for single filers and 470,700 for married couples filing jointly.

Capital Gains Tax (CGT) | Calculator | Your Investment ...

The Capital Gains Tax Estimator provides an indication of the amount of capital gains tax you may be required to pay on an investment property. Under the new Capital Gains Tax legislation which came into effect on the 30th of September, 1999, it is possible for an individual to calculate the CGT they will have to pay in one of two ways.

Low income earners in Australia pay a surprising level of ...

Jan 21, 2019· The bottom 10% claim an awful lot of capital gains – an average of A161,000 per capital gains tax payer, which is more than that claimed .

Capital gains tax was icing on a massive cake: Five key ...

As others have noted, the rich irony of the furious resistance to a capital gains tax coming from older New Zealanders was that it was always forwardlooking that the decades of taxfree gains ...

Income Tax KPMG Global

The Australian taxation system includes a capital gains tax (CGT), which in broad terms applies to certain assets acquired, or deemed to have been acquired, after 19 September 1985 upon their realization (or deemed realization).

Capital Gains Tax Check about Long Term Capital Gains ...

10% Long Term Capital Gains Tax on Capital Gains Above Lakh Introduced in Budget 2018. Arun Jaitely, the Finance Minister of India introduced long term capital gains tax on the sale of a number of prescribed securities. For the gains to be taxed, they have to be more than crore. The benefit of indexation will not be allowed on the tax ...

What you need to know about Capital Gains Tax on shares

Apr 18, 2019· What you need to know about Capital Gains Tax on shares What you need to know: Capital gains tax on shares. 18 April 2019. ... The Australian income year ends on 30 June. You have from 1 July to 31 October to lodge your tax return for the previous income year. If you use a registered tax agent to prepare and lodge your tax return, you may be ...

Calculating Capital Gains Tax (CGT) in Australia Go To Court

Calculating Capital Gains Tax or GTC can be quite complex depending upon the type of asset acquired, when it was purchased and how it was disposed of. What is CGT? CGT is a form of taxation levied by the Australian government on CGT events .

Federal election 2019: Labor's capital gains tax plan will ...

9 天前· Labor's planned changes to negative gearing may be attracting all the attention, but at least one highprofile economist thinks its proposal to halve the capital gains tax discount will have an ...

How to Calculate Capital Gains Tax | HR Block

Answer. The first step in how to calculate longterm capital gains tax is generally to find the difference between what you paid for your property and how much you sold it for—adjusting for commissions or fees. Depending on your income level, your capital gain will be taxed federally at either 0%, 15% or 20%.

Latest Posts

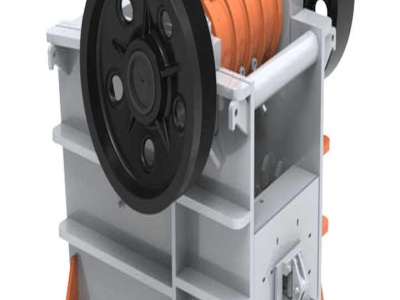

- آلة كسارة الفك وأنواع المعادن

- مجفف الرمل المحمول في بليفين

- كسارة لفة مزدوجة 800 tph

- التحليل الكيميائي للجبس لمصنع الاسمنت

- hsm ce iso مطحنة الكرة مع محرك

- تجار حجر الصنفرة في الجزائر

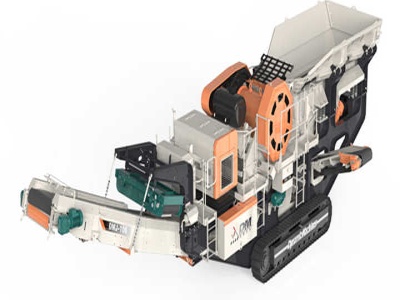

- سعر كسارة الفك المستخدمة في البنجاب

- كسارة فكية مستعملة للبيع بنغالور

- كسارة الحجر المستعملة للبيع في التنظيف

- محطات معالجة خام الكروميت

- مصنعي الكسارات ذات السمعة الطيبة من إسبانيا

- ماكينة رمل السيليكا للبيع

- كسارة خام السعودية

- آلة تعدين الذهب كسارة

- ساندر هوائي محلي تلك العلامة التجارية

- laboratory roller gtek

- industries using ball mill in nignia

- marble types and names

- metode produksi magnetit dari pasir pantai

- tungsten carbide is formed by ball milling

- dowmload mid autumn festival wish video

- grinding roller press

- mining equiment price in zimbabwe

- mobile impact crushers placer gold mining equipment

- history of poloron coolers

- automatic cnc drilling and milling machine

- hammer crusher operation in zimabbwe

- schist quarry crusher

- used jaw crusher in france

- what is the meaning of machinery cost