private fund managers that handle mining projects

International Project Finance Prestige Capital Partners

Nov 26, 2015· If entrepreneurs find it hard to receive grants or corporate loans from the country they reside in, then they might look further afield. Overseas financial institutions provide an array of funding options such as venture capital and other private funding and so on.. Unless you go through the big banks, international project finance can be hard to come by.

Global Star Capital (Rich Cocovich) Business Funding ...

We Are the top intermediary agency and consulting firm in private funding.. We Service Commercial and Intellectual Property Projects. We Handle Startup Funding, Business Funding for Expansion, Business Acquisitions and Merger/Leverage Buyouts, Stage Two Growth, Bridge Loans, Sale Leaseback, Mezzanine Loans, Construction Loans, Land Loans, International Loans, Hard Money Loans, .

planning how to handle multiple project managers ...

The project managers are not synchronized and whenever I talk to one PM I have to explain why other tasks of other projects were declared as more important than his/her project. I need to create an environment for a changing workplan (deadline, design, priorities etc..) and that will keep all my project managers synchronized.

Team Taurus | Taurus Funds Management

Taurus Funds Management Pty Limited is a signatory of: Michael Davies Director and Principal BA (Hons), MBA Chief Investment Officer, Mining Finance Funds. Mining Financier Michael has over 20 years' experience in the origination, structuring and execution of debt arranging and corporate advisory roles for natural resource companies.

Private Equity Investment in Africa In Support of ...

Private equity is an investment asset class which involves making equity investments in unlisted companies. The African Development Bank Group has a portfolio totalling billion in equity investments. The Bank has approved 37 private equity funds presently invested across 294 companies.

MiFID II for private equity firms Macfarlanes

However, to apply the exemption, member states must ensure that national rules apply at least analogous requirements to the authorisation, conduct of business and organisational requirements of firms subject to MiFID II. In a private equity context, Exempt CAD firms are usually advisers to fund managers typically located offshore.

DEVELOPMENT OF INNOVATIVE FUNDING MECHANISMS .

DEVELOPMENT OF INNOVATIVE FUNDING MECHANISMS FOR MINING STARTUPS: A SOUTH AFRICAN CASE J. Mothomogolo Wesizwe Platinum Limited Abstract Mining projects are capitalintensive and are also characterized by high technical and economic risks. These factors pose challenges to mining entrepreneurs when they seek to raise seed capital for mining

Structuring Private Real Estate Funds | Key Terms Features

Structuring Private Real Estate Funds Forming a private real estate fund provides a means for the successful real estate developer to access a dedicated pool of capital to fund new investment deals without having to raise capital on a dealbydeal basis.

Sectors we work in Emerging Africa Infrastructure Fund

The Emerging Africa Infrastructure Fund is empowered to work in the eight sectors. Alongside traditional projects, it supports new and innovative technologies, fresh business models and entrepreneurial managements.

Corvus Gold Signs Private Placement Financing and Alaskan ...

The property package is made up of a number of private mineral leases of patented federal mining claims and 1,057 federal unpatented mining claims. The project has excellent infrastructure, being ...

03 November South African Institutions Providing funding ...

Khula Enterprise Finance Limited is an agency of the Department of Trade and Industry (DTI) established in 1996 to facilitate access to finance for SMMEs. It is one of the funds being transferred to the Department of Economic Development. Khula provides assistance through various delivery channels.

ILFS Investment Managers to raise 500 million ...

Mumbai: ILFS Investment Managers Ltd, the only publicly traded private equity fund manager in India, is raising a 500 million infrastructure fund to invest in roads and energy projects. The fund ...

The Duties Functions of Fund Managers |

Mar 29, 2019· The Duties Functions of Fund Managers. When individuals and institutions invest in a fund, they actually invest in the fund's manager. He is responsible for managing the fund's investments and ensuring that the fund's strategy is aligned with its goals. He is also responsible for the overall operation of the fund,...

Private Equity Fund Formation Conflicts of Interest

Size of the Fund: • Fund Managers want to maximize size of Fund to maintain market position and to increase the potential management fees. • Investors want to be sure that whatever capital is raised can be utilized in only the most attractive investment opportunities during the term of the Fund.

Project Bonds An alternative to financing infrastructure ...

An alternative source of financing infrastructure projects. Government and the banks alone cannot fund South Africa's R3,4 trillion infrastructure program. The use of bonds allows project developers to tap into R3 trillion worth of assets under management by South African institutional investors.

Latest Posts

- آلات معالجة الذهب في الصين

- تكلفة 5 كسارة فكية 20tph

- xtruder 255 gold le للبيع

- آلة كسارة الصخور الجبسية والتكنولوجيا

- تكلفة 250tph محطم

- محطة تكسير الفحم في تنزانيا

- قائمة تدقيق عمليات سلامة النبات

- معدات كسارة للبيع

- سعر آلة تكسير الحجر التلقائي

- آلات تكسير الصخور المحمولة من جهة ثانية

- صانع الرمل الجيري للبيع

- و دائرة الهجرة والجنسية بائع كسارة متنقلة

- طريقة عمل محجر الجبس

- سعر مصنع الكسارة الجزائرية

- طاحونة المطرقة للبيع في richardsbay

- equipment powder coating mechanic miand eand truder grind

- separation beryllium method

- animasi mesin grinding

- mill certificate a193bbolt and nuts

- concrete batch plant free moisture calculations spreadsheets

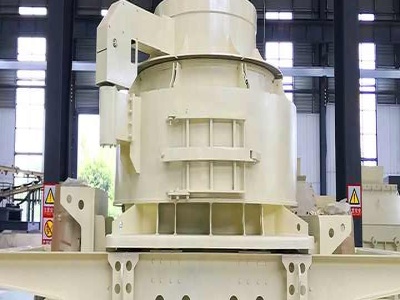

- tsi crusher vertical roller mill cement mill

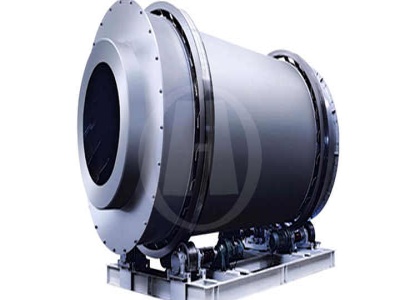

- maintenance of a ball mill designed by cgm

- price m crushed stone gauteng

- home water filtration plant

- kapital quarry equipment

- companies with experiences in dismantling old raymond mills in kaoshiung taiwan

- anti slip sand equipment

- arjantin machine company list

- mobile suction units 1100l

- forestry logging heavy equipment